Can we offer this client product X with service Y in country Z?

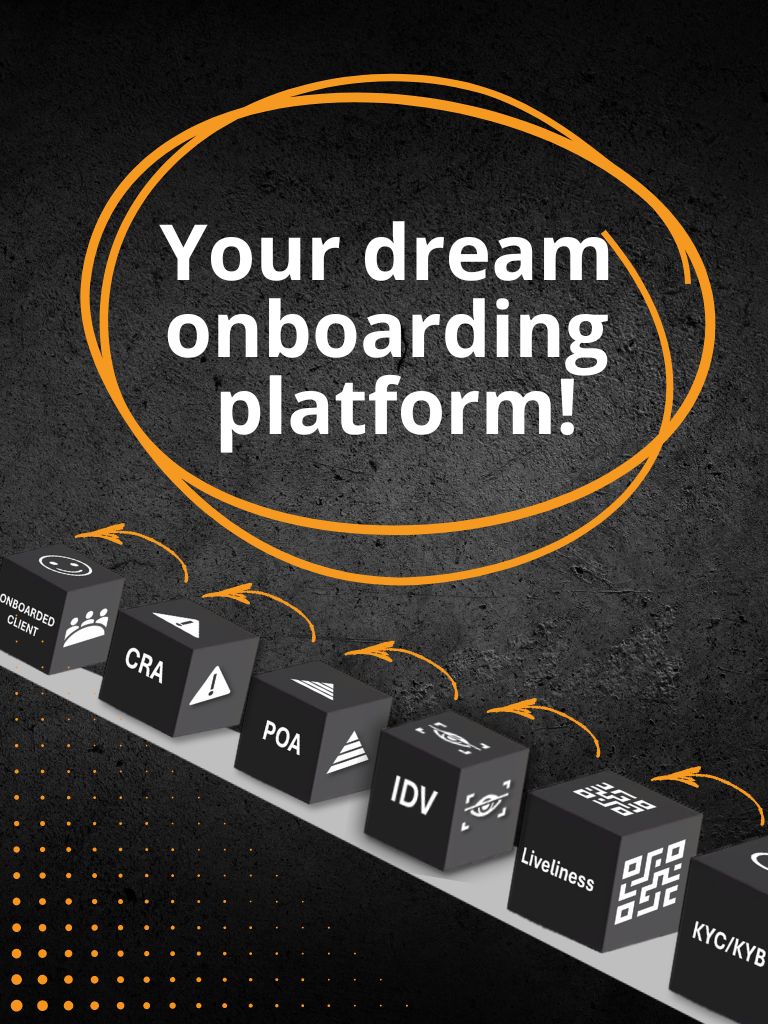

Muinmos’ platform provides financial institutions with a simple and fast way to ensure that Suitability and Appropriateness checks are done correctly at the onboarding stage – and that clients are categorised correctly and are offered the correct products and services throughout their lifecycle with the firm, even if regulatory guidelines subsequently change.

Muinmos provides full product and services cross border clearances, with instant Suitability and Appropriateness checks.

FAQ about Suitability & Appropriateness

Suitability and Appropriateness are mandatory assessments to ensure that the financial products or services offered align with the client’s profile. The Suitability test assesses whether the product is appropriate for the client’s financial goals and risk tolerance, while the Appropriateness test evaluates if the client has sufficient knowledge and experience to understand the risks involved.

These tests are crucial to protect investors by ensuring that only suitable products are recommended based on their needs and abilities. They help financial institutions comply with regulations and prevent the offering of products that are either inappropriate or poorly understood by the client.

The Suitability test is required when the financial institution is providing advice or personalized investment recommendations. The Appropriateness test is generally applied when the client is purchasing products on their own, without direct advisory services.

Muinmos offers an automated solution that ensures financial institutions can quickly and accurately assess whether a client is "appropriate" and whether a product is "suitable" for the client, in compliance with global regulations.

If a client fails the Appropriateness test, they will be warned about the risks, and the institution may choose not to offer the product. If the client is deemed unsuitable in the Suitability test, the institution should not recommend the product, as it does not align with the client’s financial goals and risk profile.

Muinmos automates the Suitability & Appropriateness tests, ensuring that financial institutions can assess their clients according to the specific regulatory requirements of each jurisdiction, mitigating regulatory risks and protecting their clients.

In the Appropriateness test, the client’s experience and knowledge of specific financial products are evaluated. In the Suitability test, the client’s financial situation, investment objectives, and risk tolerance are analysed.

Appropriateness checks whether the client can understand the product or service in terms of risk and complexity, usually in non-advised transactions. Suitability is broader, assessing whether the product fits the client’s financial profile and investment goals, and applies when advisory services are involved.

Muinmos' automated solution streamlines the verification process, eliminating time-consuming manual procedures. This allows financial institutions to conduct faster and more accurate assessments, improving the client experience and ensuring regulatory compliance.

Yes, depending on the type of transaction and jurisdiction, Suitability & Appropriateness assessments are legally required to protect investors and ensure they understand the risks and fit the profile for specific financial products.