Your Dream Client Onboarding Platform

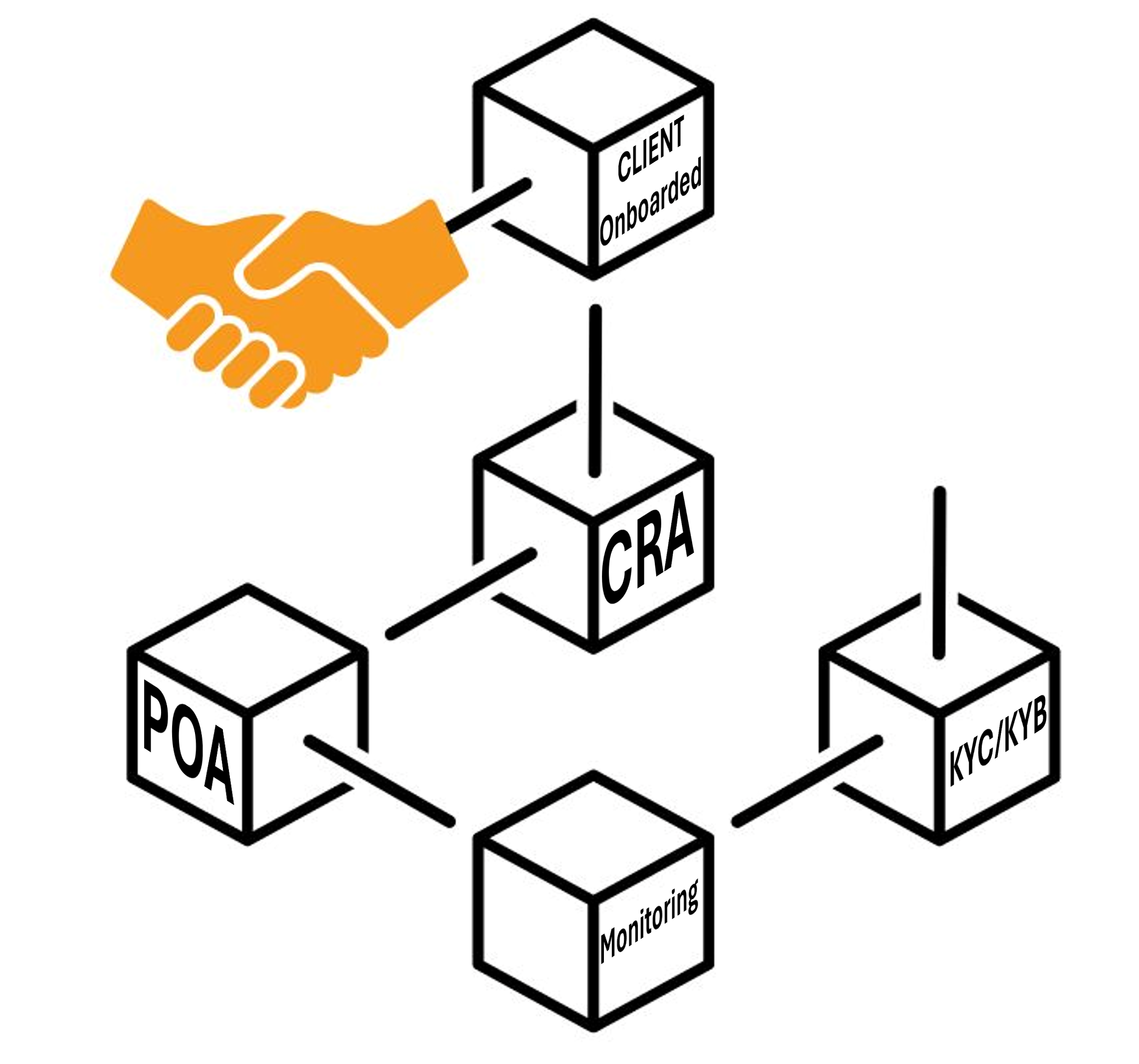

Welcome to Muinmos, the ultimate solution for regulatory compliance and financial institutions' onboarding needs. Our platform seamlessly integrates verification checks, client categorisation, and risk assessment to ensure regulatory compliance and answer the critical question: "Can we offer product X to client Y in country Z?"

While other companies struggle with regulatory compliance, Muinmos provides a streamlined solution designed for financial institutions.

Our modular platform allows institutions to customise their client onboarding process, optimising workflow and ensuring compliance with ease. Connect it with Muinmos and experience the efficiency and simplicity of seamless integration.

Gone are the days of fragmented client onboarding solutions. With Muinmos, financial institutions have everything they need to achieve regulatory compliance and streamline their client onboarding process.

Join us and revolutionise your regulatory compliance and client onboarding process today.

Your Dream Client

Onboarding Platform

Welcome to Muinmos, the ultimate solution for regulatory compliance and financial institutions' onboarding needs. Our platform seamlessly integrates verification checks, client categorisation, and risk assessment to ensure regulatory compliance and answer the critical question: "Can we offer product X to client Y in country Z?"

While other companies struggle with regulatory compliance, Muinmos provides a streamlined solution designed for financial institutions.

Our modular platform allows institutions to customise their client onboarding process, optimising workflow and ensuring compliance with ease. Connect it with Muinmos and experience the efficiency and simplicity of seamless integration.

Gone are the days of fragmented client onboarding solutions. With Muinmos, financial institutions have everything they need to achieve regulatory compliance and streamline their client onboarding process.

Join us and revolutionise your regulatory compliance and client onboarding process today.

Secure Client Onboarding with Muinmos:

Comprehensive KYC Verification

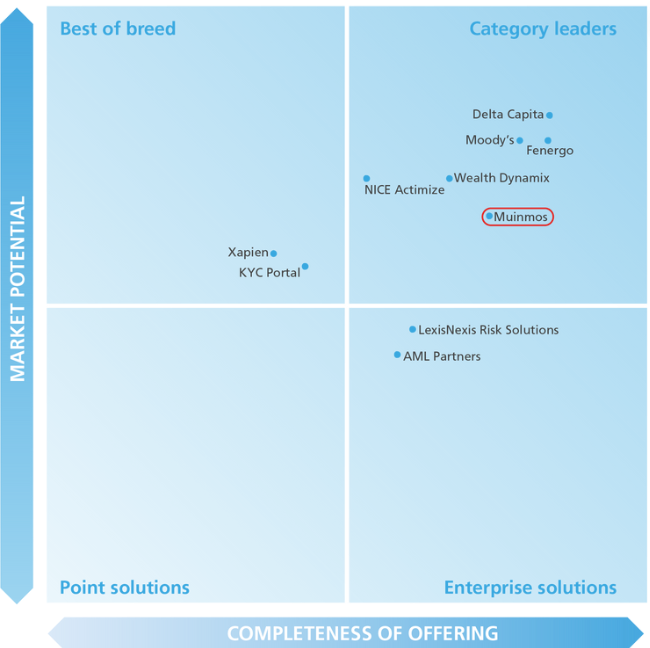

Category Leader

Chartis Research, a leading provider of research and analysis, crowned Muinmos as category leader in CLM Solutions for Wealth Management in 2023.

“Muinmos couples a deep understanding of customer pain points with a passion for overcoming these challenges, while its awards for integrated workflow and broker-dealer solutions reflect its understanding and focus.”

Nick Vitchev, Research Director at Chartis