What you can find in our Client Classification solution:

Client Classification

Muinmos’ automated client classification engine will classify your clients in accordance with the prevailing regulation, and ensure that you and your investors are protected. Whether your clients are retail, elective professional / professional opt-up, professional per se, eligible counterparts or similar, Muinmos’ regulatory engine will secure that your clients are always classified correctly.

Financial Services: Appropriateness & Suitability Assessments

With Muinmos’ regulatory engine, Suitability and Appropriateness assessments will be automatically performed, ensuring the instrument you offer your clients, whether on execution only basis, portfolio management and/ or investment advice, is appropriate and/ or suitable for them based on their financial situation, investment objectives and knowledge and experience.

Cross-Border Classification

Muinmos’ regulatory engine ensures that any client of yours, whether from your jurisdiction or outside it, is correctly classified and granted the correct level of investor protection.

Category Opt-Ups/ Elective Professional

Ensure that opting up from one category to another is done in accordance with the prevailing regulation, including the quantitative and qualitative criteria.

Products and Services Restrictions

Ensure you are fully aware of any restrictions on products or services based on the client's domicile, classification, suitability and appropriateness results and risk profiling, thus protecting you from fines and your clients against unsuitable investments and unnecessary risks.

How can your company benefit with Muinmos Client Classification solution?

Comprehensive Protection

Ensure your clients receive regulatory protection and suitable financial services at every stage of their investment journey.

Personalisation

Offer a personalised investment experience tailored to the needs and goals of each client.

Regulatory Compliance

Stay compliant with local and international regulations, avoiding penalties and legal risks.

Financial Security

Protect your clients against unsuitable investments and financial risks, ensuring a secure and reliable investment experience

FAQ about Client Classification

Our client classification process utilizes various criteria such as risk profile and investment needs to categorize clients accurately. This classification ensures that each client receives personalized financial services tailored to their individual requirements and risk tolerance levels.

Our financial services appropriateness and clearance process involves verifying the suitability of financial products and services for each client. We employ stringent measures to ensure that only appropriate options are offered and approved for investment, thus safeguarding clients from unsuitable investments.

Our evaluation and authorization process for cross-border transactions adhere to both local and international regulations. By conducting thorough assessments, we ensure regulatory compliance while minimizing financial risks associated with cross-border transactions.

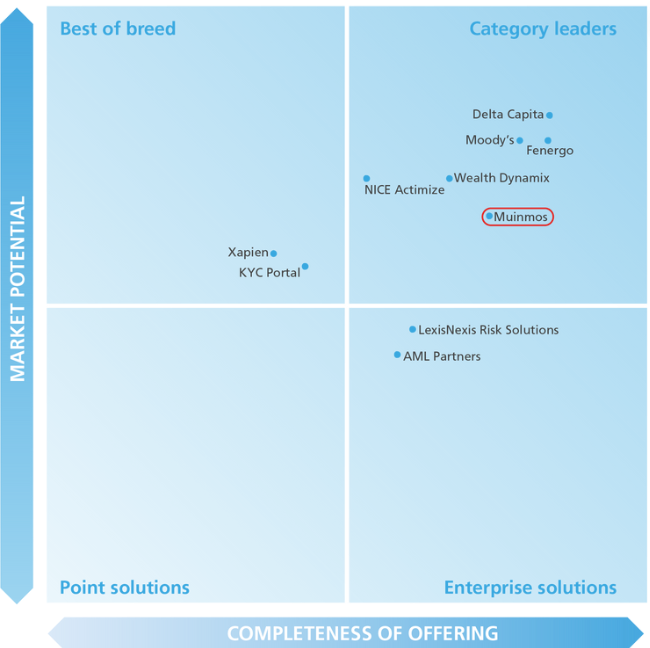

Category Leader

Chartis Research, a leading provider of research and analysis, crowned Muinmos as category leader in CLM Solutions for Wealth Management in 2023.

“Muinmos couples a deep understanding of customer pain points with a passion for overcoming these challenges, while its awards for integrated workflow and broker-dealer solutions reflect its understanding and focus.”

Nick Vitchev, Research Director at Chartis