The only Onboarding KYC software you need!

ALL YOU NEED

KYC ECOSYSTEM

The only client onboarding KYC software you need. Designed as a one-stop-shop, comprehensive solution, the Platform takes care of the entire onboarding chain, from KYC/AML, to risk assessments and client classification.

BOOST CONVERSION

AUTOMATED WORKFLOWS

Streamlining workflows across various due diligence stages, including client simplified and enhanced, improves the customer experience by enabling smoother processes and informed decision-making.

MITIGATE RISKS

WORLDWIDE DATA SUPPLIERS

Automate thorough data searches and document collection from trusted sources, in accordance with your predefined compliance policies and procedures

EASY TO CONNECT

FLEXIBLE INTEGRATION

Stand alone or fully integrated API - Different types of integration methods.

MAXIMISE EFFICIENCY

BULK UPLOAD

Effortlessly migrate existing clients with our user-friendly tools, ensuring a smooth transition, uninterrupted service and data protection. Fewer problems and worries for you and your customers!

REDUCE COSTS

PROPRIETARY AI ENGINE

Muinmos’ proprietary regulatory onboarding KYC engine is a one-of-a-kind software, that automatically classifies clients, products and services, using algorithmic rule-based Artificial Intelligence.

REMAIN COMPLIANT

EASES REMEDIATION PROJECT

Simplifies the process of fixing or addressing issues, making it easier and more manageable.

ON YOUR TERMS

CONFIGURABLE PLATFORM

Muinmos's Platform offers a range of solutions, allowing clients to choose the ones that fit their needs. Moreover, clients have the option to customise the look and feel of the Platform to align with their company's visual identity.

Increase your ROI

Save costs

Save time

01

INDUSTRY EXPERIENCE

Founded in 2012, Muinmos' team includes leading FinTech experts, combining deep experience in global financial institutions with regulatory insights.

Muinmos also relies on the expertise of its renowned partners to deliver KYC solutions worldwide.

02

INNOVATION EMPOWERING CUSTOMERS

Onboard any client type globally in under 3 minutes and improve your internal processes, operational efficiency and customer experience.

Full integration possible within just one week.

The unique onboarding solution combines AI-powered cross-border client assessments, data consolidation, and adapts to evolving regulations.

03

SECURITY AND RELIABILITY

Muinmos is ISO 27001 certified and fully EU GDPR compliant.

Our technology continuously monitors client profiles, updates risk assessments, and stays current with changing legislation throughout the client lifecycle.

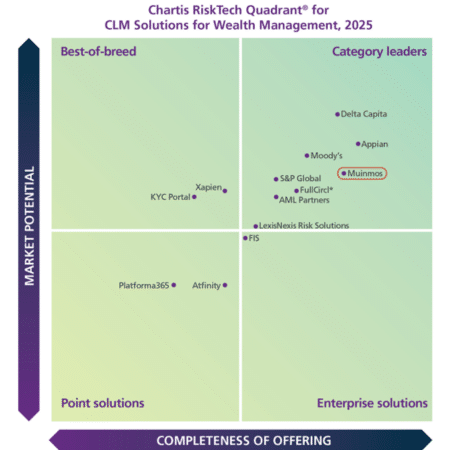

Recognized by Chartis as a top financial crime and compliance company worldwide, Muinmos was the category leader for CLM Solutions: Banks and Market Institutions in 2022. Additionally, we were named to the FinCrimeTech50 in 2024, highlighting our innovation in financial crime and fraud prevention.

01

INDUSTRY EXPERIENCE

Founded in 2012, Muinmos' team includes leading FinTech experts, combining deep experience in global financial institutions with regulatory insights.

Muinmos also relies on the expertise of its renowned partners to deliver KYC solutions worldwide.

02

INNOVATION EMPOWERING CUSTOMERS

Onboard any client type globally in under 3 minutes and improve your internal processes, operational efficiency and customer experience.

Full integration possible within just one week.

The unique onboarding solution combines AI-powered cross-border client assessments, data consolidation, and adapts to evolving regulations.

03

SECURITY AND RELIABILITY

Muinmos is ISO 27001 certified and fully EU GDPR compliant.

Our technology continuously monitors client profiles, updates risk assessments, and stays current with changing legislation throughout the client lifecycle.

Recognized by Chartis as a top financial crime and compliance company worldwide, Muinmos was the category leader for CLM Solutions: Banks and Market Institutions in 2022. Additionally, we were named to the FinCrimeTech50 in 2024, highlighting our innovation in financial crime and fraud prevention.

Category Leader

“Muinmos’ positioning ‘reflects its strong performance in data management and system interfaces/APIs. This robust functionality is underpinned by the solution’s ability to integrate with key areas such as tax, credit and legal processes, as well as its flexible workflow and change management capabilities.”

Phil Mackenzie, Research Principal at Chartis