Wealth Management

Wealth Management firms can significantly benefit from partnering with Muinmos in several ways:

1. Comprehensive Regulatory Compliance: Muinmos ensures wealth management firms meet all relevant regulatory requirements, minimizing the risk of fines and legal complications.

2. Seamless Client Onboarding: Muinmos’ advanced verification technologies streamline the onboarding process for clients, enhancing their experience and satisfaction.

3. Advanced Risk Assessment: Muinmos provides robust risk assessment tools, enabling wealth managers to identify and mitigate potential risks associated with client portfolios.

4. Enhanced Operational Efficiency: Automating KYC processes with Muinmos reduces the need for manual tasks, saving time and lowering operational costs.

5. Superior Client Service: A smooth KYC process allows wealth managers to offer more personalized and attentive service, strengthening client relationships and loyalty.

6. Proactive Compliance Management: Muinmos’ continuous monitoring ensures that wealth management firms remain compliant with evolving regulations, allowing them to focus on client wealth growth and management.

By leveraging Muinmos' technology, wealth management firms can deliver exceptional client service while maintaining robust compliance standards.

Transform your KYC onboarding process with

our fully automated SaaS Solution

FASTER and COMPLIANT

Onboard any client type globally in under 3 minutes and mitigate risks of fines, mis-selling and reputational risk.

ONBOARD MORE CLIENTS

Onboard clients you did not have the time or knowledge to previously onboard, while reducing the time to revenue by speeding up regulatory and KYC checks and focusing on growing your business safely.

LOWER COSTS

Our customers experience a significant reduction in their costs client onboarding processes.

ONGOING MONITORING

Muinmos' client onboarding platform keeps monitoring clients profiles, updates their risk assessments and keeps up-to-date with changing legislation and client risk monitored parameters.

SMOOTH CUSTOMER EXPERIENCE

Muinmos' client onboarding platform with its unique design shortens the client onboarding journey and minimises onboarding time.

FAST INTEGRATON

Muinmos' client onboarding platform is a SaaS product. No need for long bespoking processes and development.

Secure Client Onboarding with Muinmos:

Comprehensive KYC Verification

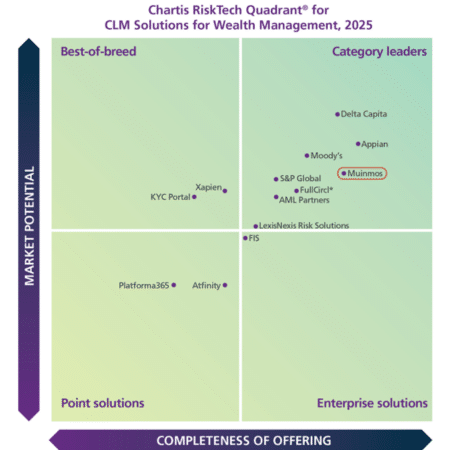

Category Leader

“Muinmos’ positioning ‘reflects its strong performance in data management and system interfaces/APIs. This robust functionality is underpinned by the solution’s ability to integrate with key areas such as tax, credit and legal processes, as well as its flexible workflow and change management capabilities.”

Phil Mackenzie, Research Principal at Chartis