Your Dream Client Onboarding Platform

Welcome to Muinmos, the ultimate solution for regulatory compliance and financial institutions' onboarding needs. Our platform seamlessly integrates verification checks, client categorisation, and risk assessment to ensure regulatory compliance and answer the critical question: "Can we offer product X to client Y in country Z?"

While other companies struggle with regulatory compliance, Muinmos provides a streamlined solution designed for financial institutions.

Our modular platform allows institutions to customise their client onboarding process, optimising workflow and ensuring compliance with ease. Connect it with Muinmos and experience the efficiency and simplicity of seamless integration.

Gone are the days of fragmented client onboarding solutions. With Muinmos, financial institutions have everything they need to achieve regulatory compliance and streamline their client onboarding process.

Join us and revolutionise your regulatory compliance and client onboarding process today.

Your Dream Client

Onboarding Platform

Welcome to Muinmos, the ultimate solution for regulatory compliance and financial institutions' onboarding needs. Our platform seamlessly integrates verification checks, client categorisation, and risk assessment to ensure regulatory compliance and answer the critical question: "Can we offer product X to client Y in country Z?"

While other companies struggle with regulatory compliance, Muinmos provides a streamlined solution designed for financial institutions.

Our modular platform allows institutions to customise their client onboarding process, optimising workflow and ensuring compliance with ease. Connect it with Muinmos and experience the efficiency and simplicity of seamless integration.

Gone are the days of fragmented client onboarding solutions. With Muinmos, financial institutions have everything they need to achieve regulatory compliance and streamline their client onboarding process.

Join us and revolutionise your regulatory compliance and client onboarding process today.

Secure Client Onboarding with Muinmos:

Comprehensive KYC Verification

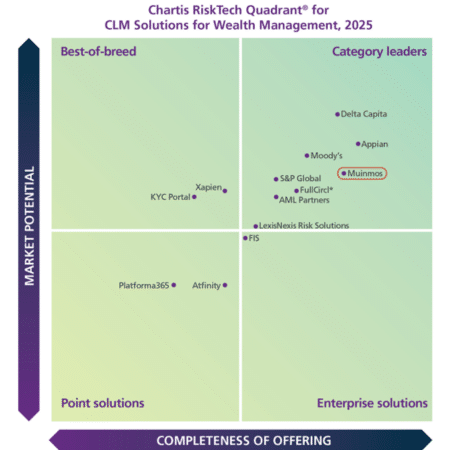

Category Leader

“Muinmos’ positioning ‘reflects its strong performance in data management and system interfaces/APIs. This robust functionality is underpinned by the solution’s ability to integrate with key areas such as tax, credit and legal processes, as well as its flexible workflow and change management capabilities.”

Phil Mackenzie, Research Principal at Chartis