What is included in Muinmos Client Risk Assessment (CRA)?

Jurisdictional Risk Assessment

Identification and analysis of risks associated with the different jurisdictions where the client operates, considering local and international regulations.

Delivery Channel Risk Assessment

Evaluation of risks involved in the delivery channels of products and services to customers, such as online, mobile, physical branches, among others.

KYC/AML Risk Assessment

Verification of customer identity and assessment of risks related to money laundering and terrorism financing, as required by Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

Product, Services, and Client Category Risk Assessment

Analysis of risks associated with the products and services offered to customers, as well as the category of clients served, to ensure a comprehensive risk management approach.

Ongoing Risk Monitoring

Implementation of a continuous monitoring system to track changes in customer risk profiles, enabling early identification of any emerging risks and the adoption of appropriate mitigating measures.

The benefits of having our Client Risk Management (CRA) solution include:

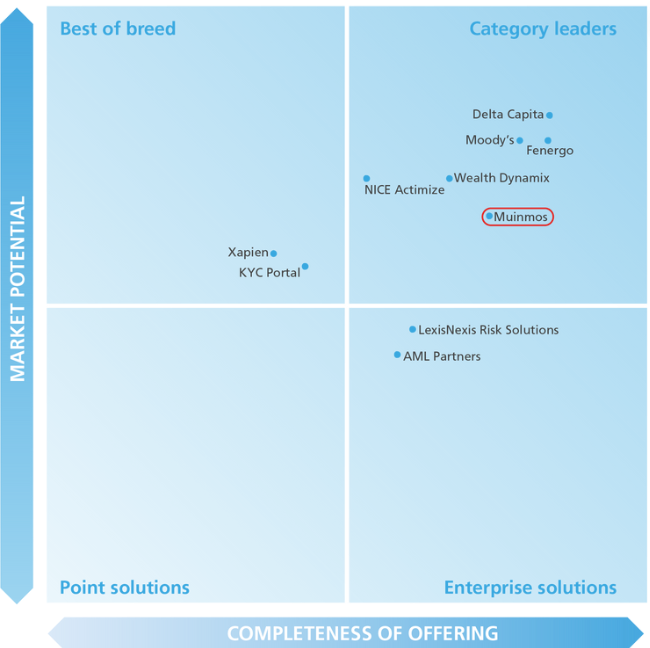

Category Leader

Chartis Research, a leading provider of research and analysis, crowned Muinmos as category leader in CLM Solutions for Wealth Management in 2023.

“Muinmos couples a deep understanding of customer pain points with a passion for overcoming these challenges, while its awards for integrated workflow and broker-dealer solutions reflect its understanding and focus.”

Nick Vitchev, Research Director at Chartis