Welcome to Muinmos

KYB Solution

Our comprehensive KYB (Know Your Business) platform offers a variety of solutions to help your company conduct thorough due diligence on your corporate clients. Below are some of the key solutions included in our KYB offering:

Muinmos KYB benefits for your company

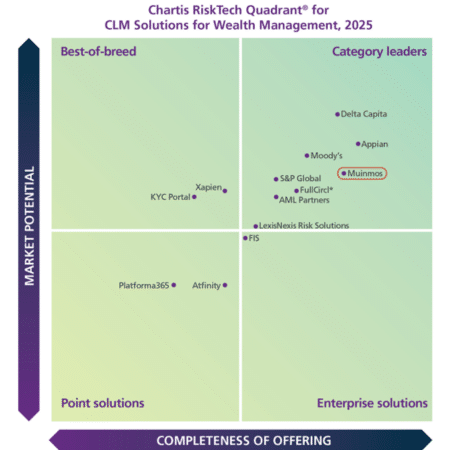

Category Leader

“Muinmos’ positioning ‘reflects its strong performance in data management and system interfaces/APIs. This robust functionality is underpinned by the solution’s ability to integrate with key areas such as tax, credit and legal processes, as well as its flexible workflow and change management capabilities.”

Phil Mackenzie, Research Principal at Chartis