Investment Banking

Investment Banking companies can greatly benefit from partnering with Muinmos in several ways:

1. Comprehensive Regulatory Adherence: Muinmos ensures investment banks meet stringent regulatory requirements, reducing the risk of sanctions and compliance breaches.

2. Efficient Client Onboarding: Muinmos' advanced verification systems expedite the onboarding of individuals and institutional clients, enhancing their onboarding experience and satisfaction.

3. Enhanced Due Diligence: Muinmos provides thorough due diligence capabilities, helping investment banks identify and mitigate risks associated with complex financial transactions.

4. Optimized Workflow Automation: Automating KYC processes with Muinmos minimizes manual tasks, leading to significant time savings and operational efficiencies.

5. Increased Transaction Security: Muinmos’ continuous monitoring tools enhance the security of transactions, ensuring a safer investment environment for clients.

6. Improved Client Relations: A streamlined KYC process allows investment banks to focus more on client relationship management, fostering stronger and more profitable client connections.

By leveraging Muinmos' technology, investment banks can navigate the complexities of regulatory compliance while prioritizing client satisfaction and business growth.

Transform your KYC onboarding process with

our fully automated SaaS Solution

FASTER and COMPLIANT

Onboard any client type globally in under 3 minutes and mitigate risks of fines, mis-selling and reputational risk.

ONBOARD MORE CLIENTS

Onboard clients you did not have the time or knowledge to previously onboard, while reducing the time to revenue by speeding up regulatory and KYC checks and focusing on growing your business safely.

LOWER COSTS

Our customers experience a significant reduction in their costs client onboarding processes.

ONGOING MONITORING

Muinmos' client onboarding platform keeps monitoring clients profiles, updates their risk assessments and keeps up-to-date with changing legislation and client risk monitored parameters.

SMOOTH CUSTOMER EXPERIENCE

Muinmos' client onboarding platform with its unique design shortens the client onboarding journey and minimises onboarding time.

FAST INTEGRATON

Muinmos' client onboarding platform is a SaaS product. No need for long bespoking processes and development.

Secure Client Onboarding with Muinmos:

Comprehensive KYC Verification

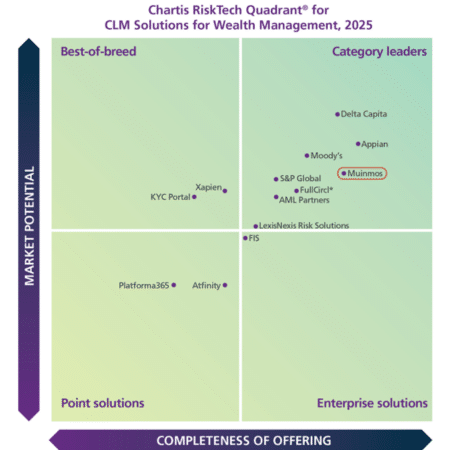

Category Leader

“Muinmos’ positioning ‘reflects its strong performance in data management and system interfaces/APIs. This robust functionality is underpinned by the solution’s ability to integrate with key areas such as tax, credit and legal processes, as well as its flexible workflow and change management capabilities.”

Phil Mackenzie, Research Principal at Chartis