Brokers

Brokers can greatly benefit from partnering with Muinmos, a KYC compliance company, in several ways:

1. Enhanced Regulatory Compliance: Muinmos ensures brokers meet all regulatory requirements efficiently, reducing the risk of penalties and legal issues.

2. Streamlined Onboarding: Muinmos offers advanced verification technologies that accelerate client onboarding, improving client satisfaction and reducing drop-offs.

3. Improved Risk Management: Muinmos helps brokers identify and mitigate potential risks through thorough background checks and continuous monitoring.

4.Increased Efficiency and Cost Savings: Automating the KYC process with Muinmos reduces manual workload, saving time and operational costs.

5. Better Customer Experience: A seamless KYC process enhances customer experience, leading to higher client retention and referrals.

By leveraging Muinmos' expertise and technology, brokers can focus on business growth while ensuring robust compliance.

Secure Client Onboarding with Muinmos:

Comprehensive KYC Verification

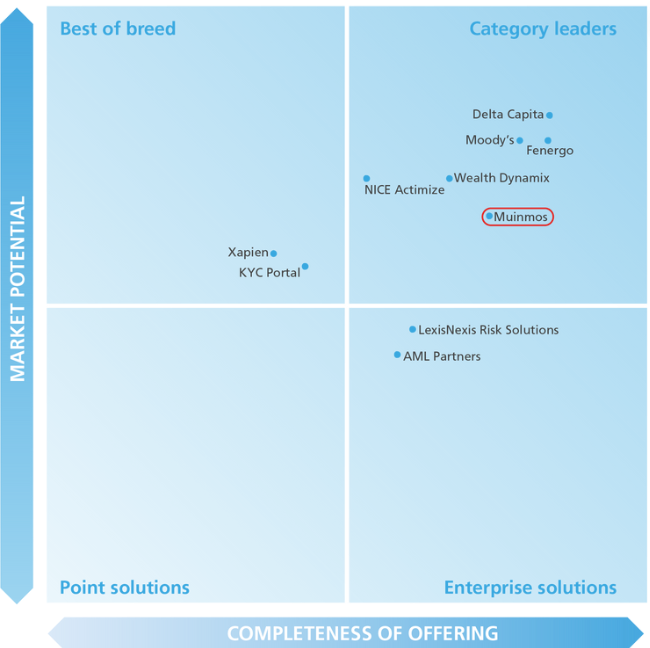

Category Leader

Chartis Research, a leading provider of research and analysis, crowned Muinmos as category leader in CLM Solutions for Wealth Management in 2023.

“Muinmos couples a deep understanding of customer pain points with a passion for overcoming these challenges, while its awards for integrated workflow and broker-dealer solutions reflect its understanding and focus.”

Nick Vitchev, Research Director at Chartis