Welcome to Your Dream

Client Onboarding Platform

Muinmos connects KYC checks, client classification and risk assessment (CRA), enabling the entire client onboarding process instantly.

Transform your KYC onboarding process with our

fully automated SaaS Solution

FASTER and COMPLIANT

Onboard any client type globally instantly and mitigate risks of fines, mis-selling and reputational risk.

ONBOARD MORE CLIENTS

Onboard clients you did not have the time or knowledge to previously onboard, while reducing the time to revenue by speeding up regulatory and KYC checks and focusing on growing your business safely.

LOWER COSTS

Our customers experience a significant reduction in their costs client onboarding processes.

ONGOING MONITORING

Muinmos' client onboarding platform keeps monitoring clients profiles, updates their risk assessments and keeps up-to-date with changing legislation and client risk monitored parameters.

SMOOTH CUSTOMER EXPERIENCE

Muinmos' client onboarding platform with its unique design shortens the client onboarding journey and minimises onboarding time.

FAST INTEGRATON

Muinmos' client onboarding platform is a SaaS product. No need for long bespoking processes and development.

Testimonials

One interconnected ecosystem or a set of components to optimise your workflow!

Know your Customer (KYC)

Ensure customer verification: Utilise an integrated platform for automated KYC Onboarding, Risk Assessment and Regulatory Compliance to accurately authenticate customers.

- PEPS & Sanctions

- Adverse Media

- eKYC

- IDv

- Liveliness

- Ongoing Monitoring

Know Your Business (KYB)

Our comprehensive KYB platform offers a variety of solutions to help your company conduct thorough due diligence on your corporate clients.

- Sanction Screening

- Adverse Media Screening

- Company Validation

- Directors

- Industry Code

- Ultimate Beneficial Owners

- Group Structure(s)

- Corporate Filing

- Credit Rating

Client Classification

- Classification of clients (Retail, Pro, ECP and similar)

- Financial Services and Products Suitability Assessment and Clearance

- Financial Services and Products Appropriateness Assessment and Clearance

- Cross-Border Product and Service Clearance

- Category Opt-Ups Clearance

- Products and Services Restriction Clearance

Client Risk Assessment (CRA)

- Jurisdictional Risk Assessment

- Delivery Channel Risk Assessment

- KYC|AML Risk Assessment

- Product, Services, and Client Category Risk Assessment

- Ongoing Risk Monitoring

MUINMOS WHITE PAPER

Turn KYC Client Onboarding

into a Competitive Advantage

Download the Muinmos White Paper to accelerate client onboarding, improve compliance, and streamline Client Classification & Suitability Assessments.

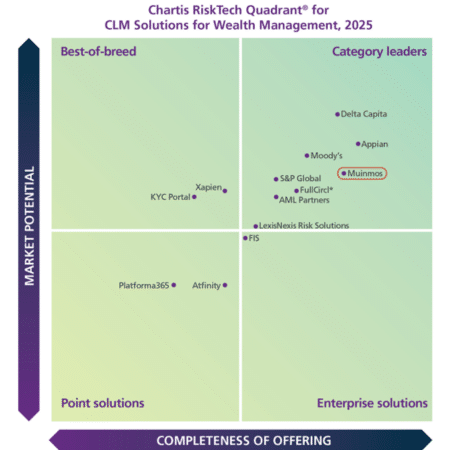

Category Leader

“Muinmos’ positioning ‘reflects its strong performance in data management and system interfaces/APIs. This robust functionality is underpinned by the solution’s ability to integrate with key areas such as tax, credit and legal processes, as well as its flexible workflow and change management capabilities.”

Phil Mackenzie, Research Principal at Chartis

Trustworthy Accolades: Recognitions You Can Rely On

PARTNERSHIP

Why We Partner with Global Leaders & How You Benefit

At Muinmos, we collaborate with top global data providers to ensure efficient and secure compliance checks. Our platform integrates with services like PEPs, Sanctions, Adverse Media, and ID verification to streamline your compliance journey.