Navigating the Evolving Regulatory Landscape in the FX Industry

Introduction

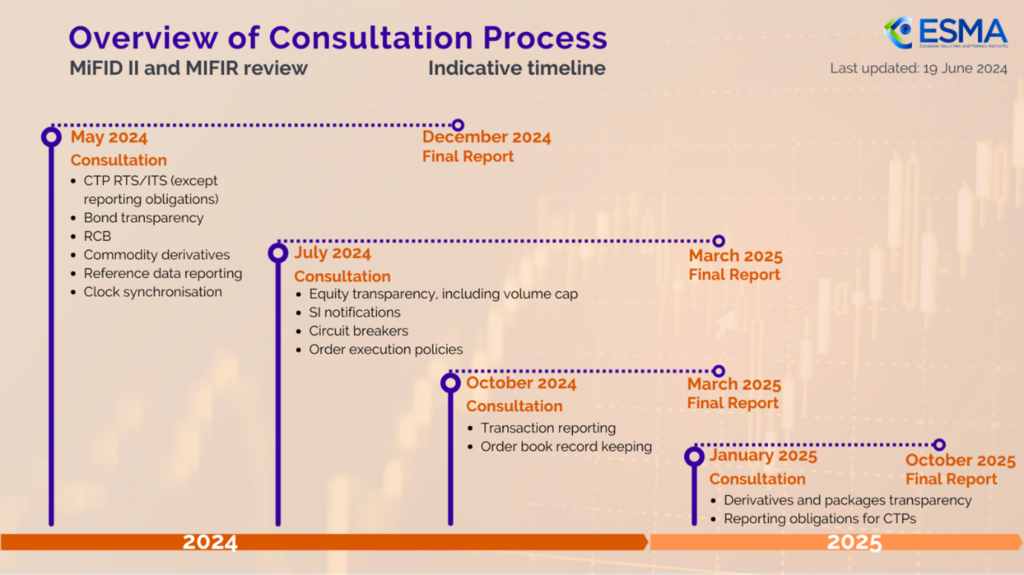

The financial services industry, particularly the FX sector, operates in a dynamic regulatory environment. For example, in the EU, MiFID II and MiFIR are currently in a comprehensive review process, scheduled to proceed well into 2025, and include major changes to, among other things, derivatives transparency requirements.

And this is, of course, just one regulator of many. In the UK, for example, the FCA is consulting on moving the MiFID Org Reg into the handbook; and similar regulatory overhauls are being conducted worldwide.

This continuous regulatory attention, along with a constantly growing emphasis on compliance and heightened regulatory expectations, pose significant challenges to financial institutions; but also present countless opportunities for differentiating themselves and improving their competitiveness.

In this article we delve into insights shared by Remonda Kirketerp-Møller, CEO at Muinmos, during her interview at the IFX Expo International in Limassol, Cyprus. Remonda’s extensive experience offers a unique perspective on the current state and future of FX regulation, the importance of KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance, and the critical role of education and innovation in addressing these challenges.

The Appeal of the FX Sector Amid Complex Regulations

Despite the growing regulatory scrutiny, the FX sector remains an attractive space for businesses. According to Remonda Kirketerp-Møller, “The sector continues to be appealing because, while many regulations have been introduced, the focus has been on consolidating and adapting these rules to better fit the digital environment.” This approach by regulators aims to clarify and bring relevance to a framework initially unprepared for the digital age.

Remonda emphasizes that the attraction lies in the regulators’ efforts to make the regulatory framework more coherent and aligned with current market realities. The adaptability and resilience of companies operating within this framework have contributed to the continued appeal of the FX sector.

Global Regulatory Uniformity: A Double-Edged Sword

The push for regulatory uniformity across different regions is seen as both a necessity and a challenge. Remonda points out that “While learning from other jurisdictions is positive, the practice of simply copying and pasting rules can lead to significant issues.” Uniformity is crucial for ensuring a level playing field; however, it must be implemented with a deep understanding of local market specifics.

The tendency of both companies and regulators to adopt practices from other regions without fully grasping the local context can lead to inefficiencies and unintended consequences. For example, Remonda highlights the potential pitfalls of regulatory arbitrage, where financial institutions might relocate to jurisdictions with less stringent regulations, thereby undermining the intended regulatory impact.

Shifting Leadership in Global Regulation

The regulatory landscape has seen a shift in leadership over the years. Remonda notes that “In the past, the United States was at the forefront of setting regulatory standards, but now the UK, through the FCA, has taken the lead.” The UK’s proactive approach, particularly with the introduction of regulatory sandboxes and the integration of new technologies, positions it as a leader in digital market regulation.

This shift signifies a move towards a more collaborative and understanding regulatory approach, contrasting with the historically punitive stance of U.S. regulators. The UK’s emphasis on innovation and technology-driven solutions serves as a model for other jurisdictions aiming to keep pace with the rapidly evolving financial services landscape.

Differentiating KYC and AML Solutions in a Crowded Market

In discussing the KYC and AML solutions provided by Muinmos, Remonda underscores the company’s unique approach: “We differentiate ourselves by connecting all the dots in the onboarding process, offering a transparent structure that meets the local jurisdictional needs of institutions.” This comprehensive and integrated solution sets Muinmos apart in a market where many providers offer fragmented services.

Muinmos’ approach to KYC and AML is designed to ensure that institutions can comply with varying regulatory requirements across jurisdictions efficiently. By automating and streamlining the compliance process, Muinmos helps institutions navigate the complexities of regulatory demands while minimizing operational burdens.

Addressing the Challenges of Geographic Expansion

As financial institutions expand globally, they encounter diverse regulatory requirements that complicate compliance efforts. Remonda stresses the importance of digitization and automation in overcoming these challenges: “Relying solely on legal teams or extensive compliance departments is not enough; automation and collaboration with knowledgeable providers are essential.”

The complexity of differing regulatory frameworks across jurisdictions necessitates a more sophisticated approach to compliance. Automated solutions that are adaptable to various regulatory environments are crucial for institutions aiming to maintain compliance while expanding their global footprint.

Regulatory Restrictions in Europe: Balancing Protection and Freedom

The recent regulatory restrictions on marketing high-risk derivative products to retail clients in Europe have sparked debate. Remonda expresses concern over regulators’ approach of imposing bans rather than addressing the underlying issues: “Instead of restricting adults’ freedom to make informed decisions, regulators should focus on resolving regulatory challenges effectively.”

She believes that these restrictions may lead to regulatory arbitrage, where institutions move operations to jurisdictions with more lenient regulations. This shift does not solve the core issues but rather relocates them. Remonda advocates for a regulatory approach that prioritizes understanding and resolving the root causes of problems instead of imposing blanket restrictions.

The Importance of Education in the Financial Market

Education is a recurring theme in Remonda’s discourse on effective regulation. She argues that many current issues could be addressed through better education rather than restrictive regulation: “The key to solving many of the problems we face today lies in allowing brokers to educate their clients about the risks and benefits of financial products.”

According to Remonda, education is essential for enhancing compliance and transparency within the sector. Regulators and institutions alike should focus on providing clear, accessible information to clients, empowering them to make informed decisions.

Future Regulatory Challenges and the Path Forward

Looking ahead, Remonda identifies a significant concern: the tendency of regulators to copy each other’s frameworks without considering local specificities. She warns that “This could lead to ineffective regulation and increased regulatory arbitrage.”

To address this, Remonda suggests that regulators hire more market experts and collaborate to develop guidelines tailored to their specific contexts. A more nuanced understanding of local market dynamics is essential for creating effective regulatory frameworks that do not stifle innovation or drive businesses to relocate to more lenient jurisdictions.

Conclusion

Remonda Kirketerp-Møller’s insights provide a critical examination of the current regulatory landscape in the FX sector. Her emphasis on education, innovation, and a collaborative approach to regulation offers a roadmap for navigating the challenges ahead. As the regulatory environment continues to evolve, institutions must adapt by embracing automation, prioritizing education, and advocating for regulatory frameworks that are both effective and contextually relevant.

The future of the FX industry will be shaped by how well regulators and market participants respond to these challenges. By fostering a deeper understanding of market dynamics and focusing on informed decision-making, the sector can continue to thrive in an increasingly regulated world.

This article has synthesized key insights from the interview, offering a comprehensive view of the regulatory challenges and opportunities facing the FX sector today. Through the lens of Remonda Kirketerp-Møller’s expertise, it presents actionable recommendations for institutions and regulators alike, highlighting the critical role of education, innovation, and collaboration in shaping the future of financial regulation.

Enhance Cross-Border Client Classification and Suitability & Appropriateness Assessments. Download Muinmos’ white paper now “Want to turn KYC Client Onboarding into a competitive advantage?”

Discover how Muinmos can help you achieve seamless KYC onboarding and simplify compliance for you.