3 Innovative Strategies to Stay Ahead of Competition in the Financial Sector

In today’s fast-paced financial landscape, staying ahead of the competition requires more than just keeping up with regulations. Compliance is no longer just about risk management; it can also be a key driver of business growth. By leveraging innovative strategies, firms can turn compliance into a competitive advantage. In this article, we explore three powerful strategies that will help you optimise compliance processes, improve operational efficiency, and boost overall business performance.

Time is Money

In a recent order, the US SEC heavily penalised (USD 1.19M civil money penalty, censure, cease-and-decease order and a lengthy remediation process) a brokerage that did not allocate enough resources to reviewing trade alerts. The SEC examined exactly how much time was spent on the task (2 employees, five hours per month) and concluded that was not enough.

Avoid this pitfall – make sure your Compliance Team’s time is well-spent. Compliance teams have endless tasks. Automate the repetitive technical tasks, and allow them to focus on the high-end tasks, such as judgement calls and policy making.

This will not only improve your compliance and operational efficiency but will also make your Compliance Teams more content at their roles, as they will not be “pushing papers” from one end to the other, but making high-end, high-value decisions using their professional capacities.

The Automation Axis

Don’t just automate, automate with efficiency.

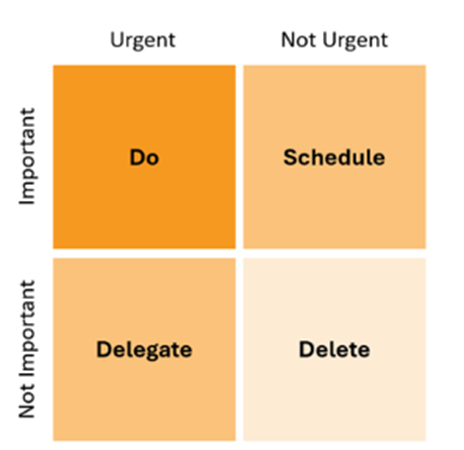

There are various types of prioritization matrices. The famous “Eisenhower Matrix” calls you to prioritize tasks which are both important AND urgent; delegate the ones which are urgent but not important; schedule the ones who are important but not urgent; and delete the ones who are neither important nor urgent.

The “Eisenhower Matrix”

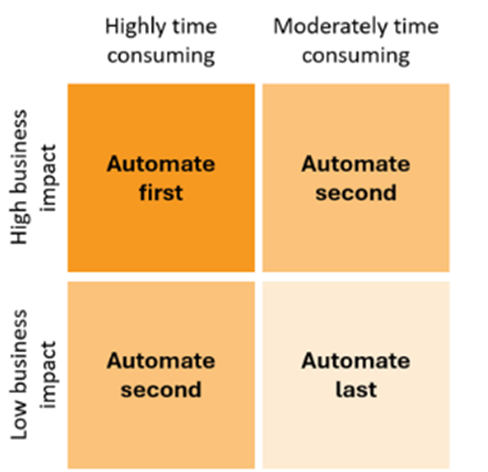

Building on this logic, one should first automate tasks which are both highly time consuming and have a high impact on business; second, one should automate tasks which are either moderately time consuming but have high business impact or ones which are highly time consuming but have low business impact; and lastly, the ones who have low business impact and are only moderately time consuming.

The “Automation Matrix”

This type of smart allocation of resources will allow you not only to achieve a quick ROI but also a quick visible impact to the business’ compliance culture as a whole.

Competitive Compliance

Compliance is often seen as a business-inhibitor. No reason for that! A well-constructed compliance process not only does not prevent the company from doing business, but actually enables it do more!

For example, correct Client Classification can allow your firm to sell more products to larger groups of customers, and a more smooth onboarding process can give your firm a competitive advantage by allowing it to get quicker to the trading stage.

Work with Business functions to ease their pain-points, to open-up new markets and opportunities and improve customer experience.

In Conclusion

Free your Compliance Team from repetitive, low-value tasks so they can handle high-end, judgement necessitating tasks. This will not only make your compliance processes more efficient and cost effective, but also hugely improve your Compliance Team’s work satisfaction.

Start with the manual tasks that take away from your team the most work-hours, in the areas that will impact your business the most.

This way, you can turn your compliance processes from a perceived burden to a visible competitive advantage.